1 Introduction

Regression analyzes are very common and should therefore be mastered by every data scientist.

For this post the dataset House Sales in King County, USA from the statistic platform “Kaggle” was used. You can download it from my GitHub Repository.

2 Loading the libraries and the data

import pandas as pd

import numpy as np

import statsmodels.formula.api as smf

import matplotlib.pyplot as plt

from sklearn.linear_model import LinearRegression

from sklearn.model_selection import train_test_split

from sklearn import metricshouse_prices = pd.read_csv("path/to/file/house_prices.csv")3 Implementing linear regression with the statsmodel library

3.1 Simple linear Regression

Following, a simple linear regression with the variables ‘price’ and ‘sqft_living’ is to be performed.

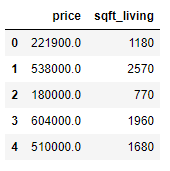

HousePrices_SimplReg = house_prices[['price', 'sqft_living']]

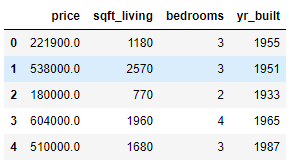

HousePrices_SimplReg.head()

x = HousePrices_SimplReg['sqft_living']

y = HousePrices_SimplReg['price']

plt.scatter(x, y)

plt.title('Scatter plot: sqft_living vs. price')

plt.xlabel('sqft_living')

plt.ylabel('price')

plt.show()

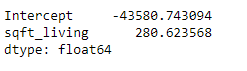

model1 = smf.ols(formula='price~sqft_living', data=HousePrices_SimplReg).fit()The coefficients of the model are obtained in the following way:

model1.params

The result can be interpreted as follows: price = -43.580,74 + 280,62 * sqft_living

Hereby we get the R2:

model1.rsquared

With the summary function all model parameters can be displayed:

model1.summary()

With the perdict function, predictions can now be made based on the model created.

price_pred = model1.predict(pd.DataFrame(HousePrices_SimplReg['sqft_living']))For an assessment how well our model fits the data the following parameters are calculated:

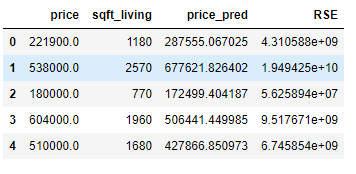

HousePrices_SimplReg['price_pred'] = price_pred

HousePrices_SimplReg['RSE'] = (HousePrices_SimplReg['price'] - HousePrices_SimplReg['price_pred']) ** 2

RSEd = HousePrices_SimplReg.sum()['RSE']

RSE = np.sqrt(RSEd/21611)

criteria_mean = np.mean(HousePrices_SimplReg['price'])

error = RSE/criteria_mean

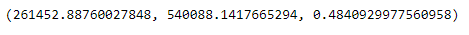

RSE, criteria_mean, error

Results of parameters:

- RSE = 261.452,89

- Mean of actal price = 540.088,14

- Ratio of RSE and criteria_mean = 48,41%

HousePrices_SimplReg.head()

3.2 Multiple Regression

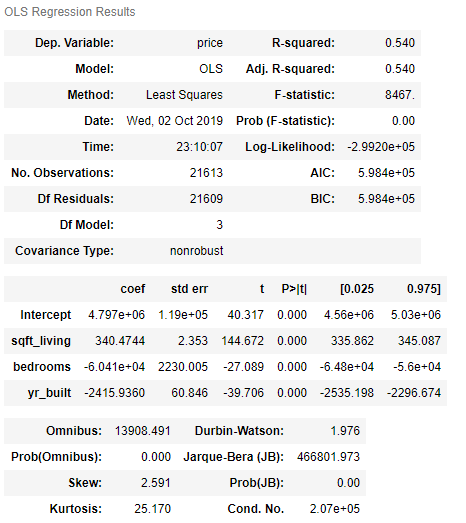

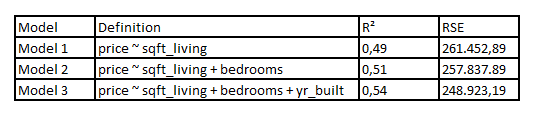

Now we try to improve the predictive power of the model by adding more predictors. Therefore we’ll have a look at the R-squared, the F-statistic and the Prob (F-statistic).

HousePrices_MultReg = house_prices[['price', 'sqft_living', 'bedrooms', 'yr_built']]

HousePrices_MultReg.head()

- Model 1: price ~ sqft_living

- Model 2: price ~ sqft_living + bedrooms

- Model 3: price ~ sqft_living + bedrooms + yr_built

model2 = smf.ols(formula='price~sqft_living+bedrooms', data=HousePrices_MultReg).fit()model2.params

model2.summary()

price_pred = model2.predict(HousePrices_MultReg[['sqft_living', 'bedrooms']])HousePrices_MultReg['price_pred'] = price_pred

HousePrices_MultReg['RSE'] = (HousePrices_MultReg['price'] - HousePrices_MultReg['price_pred']) ** 2

RSEd = HousePrices_MultReg.sum()['RSE']

RSE = np.sqrt(RSEd/21610)

criteria_mean = np.mean(HousePrices_MultReg['price'])

error = RSE/criteria_mean

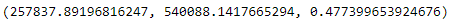

RSE, criteria_mean, error

Results of parameters:

- RSE = 257.837.89

- Mean of actal price = 540.088.14

- Ratio of RSE and criteria_mean = 47,74%

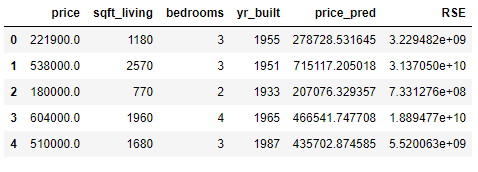

HousePrices_MultReg.head()

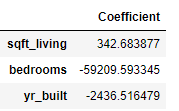

model3 = smf.ols(formula='price~sqft_living+bedrooms+yr_built', data=HousePrices_MultReg).fit()model3.params

model3.summary()

price_pred = model3.predict(HousePrices_MultReg[['sqft_living', 'bedrooms', 'yr_built']])HousePrices_MultReg['price_pred'] = price_pred

HousePrices_MultReg['RSE'] = (HousePrices_MultReg['price'] - HousePrices_MultReg['price_pred']) ** 2

RSEd = HousePrices_MultReg.sum()['RSE']

RSE = np.sqrt(RSEd/21609)

criteria_mean = np.mean(HousePrices_MultReg['price'])

error = RSE/criteria_mean

RSE, criteria_mean, error

Results of parameters:

- RSE = 248.923,19

- Mean of actal price = 540.088,14

- Ratio of RSE and criteria_mean = 46,09%

Below is an overview of the major results of the created models:

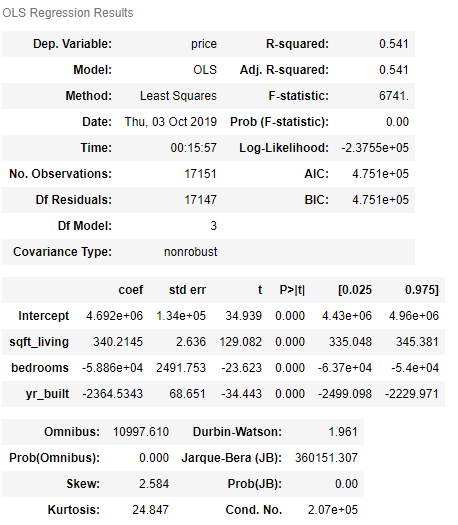

3.3 Model validation

We saw that model 3 delivered the best values. Therefore, our linear model is trained with this. Afterwards the performance will be measured.

a = np.random.randn(len(HousePrices_MultReg))

check = a < 0.8

training = HousePrices_MultReg[check]

testing = HousePrices_MultReg[~check]print(training.shape)

print(testing.shape)

Let’s train our model

model4 = smf.ols(formula='price~sqft_living+bedrooms+yr_built', data=training).fit()

model4.summary()

Now we use the trained model for the predictions:

price_pred = model4.predict(testing[['sqft_living', 'bedrooms', 'yr_built']])Check the model performance with the test data:

Important: For the calculation shown below, the Df residuals from the test record must be used. These can be determined as follows.

df_testing_model = smf.ols(formula='price~sqft_living+bedrooms+yr_built', data=testing).fit()

df_testing_model.summary()

Model performance:

testing['price_pred'] = price_pred

testing['RSE'] = (testing['price'] - testing['price_pred']) ** 2

RSEd = testing.sum()['RSE']

RSE = np.sqrt(RSEd/4458)

criteria_mean = np.mean(testing['price'])

error = RSE/criteria_mean

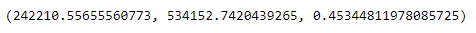

RSE, criteria_mean, error

Results of parameters:

- RSE = 242.210,56

- Mean of actal price = 534.152,74

- Ratio of RSE and criteria_mean = 45,34%

Both models are almost identical in comparison. However, the F-values are worse for the split model. This is normal because there was less data available for creating the model.

4 Linear Regression with scikit-learn

The library scikit-learn is also very good for training models. A brief insight should give the following example.

feature_cols = ['sqft_living', 'bedrooms', 'yr_built']

x = HousePrices_MultReg[feature_cols]

y = HousePrices_MultReg['price']

trainX, testX, trainY, testY = train_test_split(x, y, test_size = 0.2)

lm = LinearRegression()

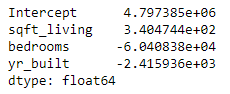

lm.fit(trainX, trainY)print(lm.intercept_)

print(lm.coef_)

The result can be interpreted as follows: price = 4.829.374,95 + 342,68 * sqft_living - 59.209,59 * bedrooms - 2.436,52 * yr_built

The coefficients can also be displayed more beautifully in the following two ways:

list(zip(feature_cols, lm.coef_))

coeff_df = pd.DataFrame(lm.coef_, feature_cols, columns=['Coefficient'])

coeff_df

Calculation of R²:

lm.score(trainX, trainY)

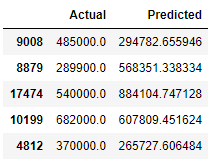

y_pred = lm.predict(testX)df = pd.DataFrame({'Actual': testY, 'Predicted': y_pred})

df.head()

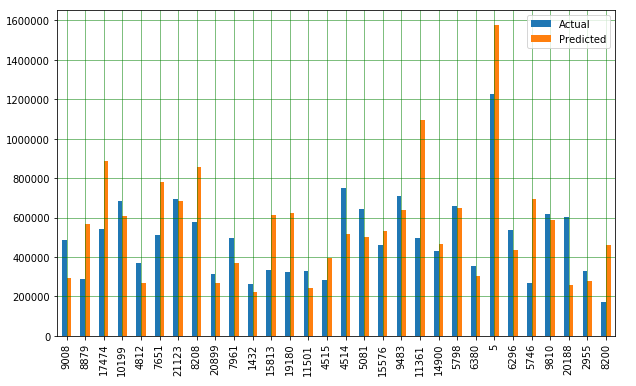

Now let’s plot the comparison of Actual and Predicted values

df1 = df.head(30)

df1.plot(kind='bar',figsize=(10,6))

plt.grid(which='major', linestyle='-', linewidth='0.5', color='green')

plt.grid(which='minor', linestyle=':', linewidth='0.5', color='black')

plt.show()

print('Mean Absolute Error:', metrics.mean_absolute_error(testY, y_pred))

print('Mean Squared Error:', metrics.mean_squared_error(testY, y_pred))

print('Root Mean Squared Error:', np.sqrt(metrics.mean_squared_error(testY, y_pred)))

What these metrics mean and how to interpret them I have described in the following post: Metrics for Regression Analysis

5 Conclusion

This was a small insight into the creation and use of linear regression models. In a subsequent post, the possible measures for the preparation of a linear model training will be shown. In a further contribution methods are to be shown how the predictive power of a linear model can be improved.